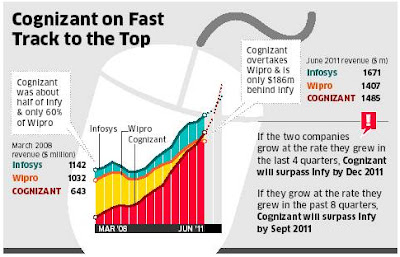

Going by its average growth in past few quarters, co may topple Infy as second-biggest IT exporter as early as Q3

Cognizant has rearranged the Indian IT sector’s pecking order of years, with its quarterly revenues racing past that of No. 3 software exporter Wipro Technologies. And its growth clip is such that it could dislodge the one-time growth monster, Infosys Technologies, before the year-end.

The Chennai-based company posted a 34.4% rise in revenues to $1.485 billion in the April-June quarter, nearly $77 million more than Wipro’s sales during the same period, and joined sector leader Tata Consultancy Services and multinational rivals IBM and Accenture in giving an upbeat assessment for the outsourcing business. “While uncertainty has increased in the macro environment, clients recognise volatility as the ‘new normal’. They continue to act on this dual mandate, and, as a result, we see a pipeline that is quite robust,” said Cognizant President and CEO Francisco D’Souza.

Shares in the company, which is headquartered and listed in the US, were up 2.20% at $72.25 in Nasdaq opening trade. The company, which counts JPMorgan, American Express and Pfizer among its top customers, said net profit for the quarter rose 21% to $208 million. Wipro’s net profit rose just 1% in the same period to $299 million while Infosys’ quarterly profit rose 17%.

An analysis by ET shows if Cognizant maintains its average revenue growth clip of 34% in the past eight quarters, it could overtake Infosys’ quarterly revenues in the July-September quarter.

Industry experts say the results of TCS and Cognizant, besides highlighting a new pecking order in Indian IT, also provide a peek into what strategies are working. Coming out of the 2008-09 recession, TCS and Cognizant seem to have prospered, reporting strong earnings and issuing optimistic outlook statements. In contrast, Bangalore-based Infosys and Wipro have appeared bogged down, battling a tough market and weighed down by management issues.

“We are now seeing some separation even among the Tier I players… For Cognizant, this is an affirmation of their sales model and investment in relationships in the peer group,” said Nikhil Rajpal, partner with outsourcing advisory firm Everest Group. Hits upon a Winning Formula

He said Cognizant had the highest sales, general and administrative expenses in the sector, which showed its aggression in spending to win new business.

As the Bangalore big two wrestled with internal problems, Cognizant steadily narrowed its revenue gap with them. At the end of March 2010, there existed a $206-million gap between Cognizant and Wipro and some $329 million separated it from Infosys. A little over a year later, it has overtaken Wipro and narrowed the gap with Infosys to $186 million.

“You are beginning to wonder if all these companies are addressing the same market,” said a senior official at one of the Indian tech firms that competes with Cognizant for business from banking customers in the US.

Some experts say Cognizant appears to have hit upon a winning formula of balancing customer intimacy and operational excellence.

“They recruit a much higher percentage of lateral staff in India and in client-facing roles a greater number of local staff with strong consultative business and domain capabilities,” said Peter Schumacher, president & CEO of consulting company Value Leadership Group. “With the exception of TCS, customers see the other large firms as much more passive and lacking these capabilities.”

This comment has been removed by the author.

ReplyDeleteKnowledge World

ReplyDeleteThe blogs I follow:

ReplyDeleteKnowledge World

ebooks download

unlock code samsung

drivers download zone

unlock code

new information technology information